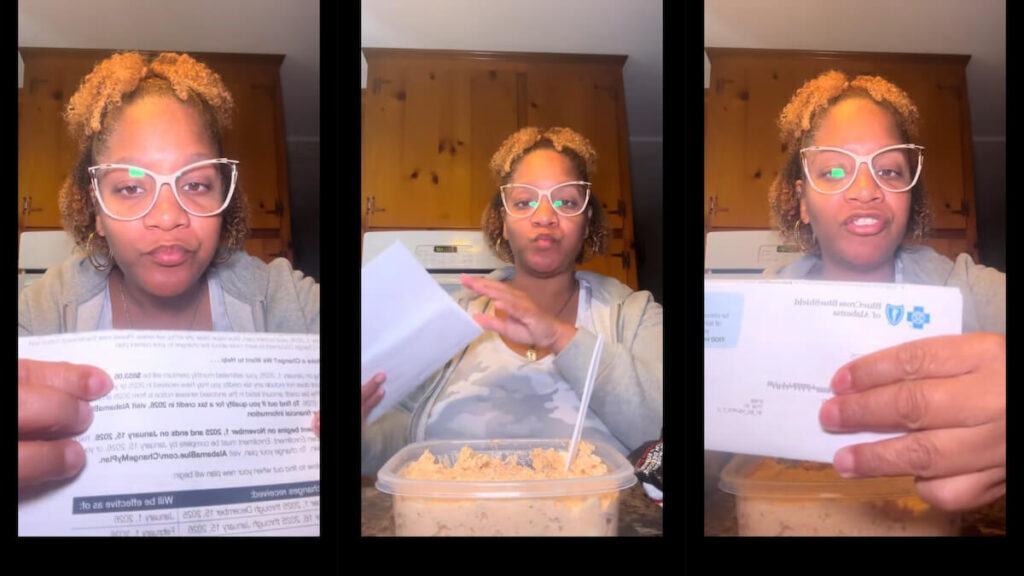

A woman from Alabama is still trying to come out of her shocked state after opening a letter from her health insurance provider and learning that her monthly premium would be increasing by hundreds of dollars. The woman, who shared her reaction in a TikTok video, said she currently pays $122 a month for her Blue Cross health insurance plan. According to the renewal notice she received, beginning January 1, 2026, that monthly cost is set to rise to $853.05.

The woman held up the paperwork for viewers to see as proof, still stunned that the increase was real. “They have absolutely lost their [expletive] minds,” she said. She explained that she is self-employed and relies on her current coverage to stay insured, but the new price would make it impossible for her to continue the plan. “A lot of people are about to be without health insurance,” she said. “I’m not about to pay $853 for health insurance. And that’s just for me. This is completely insane. What is going on?”

For her, and for many others in similar situations, the sudden spike raises an unsettling question: how are people supposed to afford necessary healthcare when premiums continue to rise but wages and coverage do not?

Netizens React to the Alabama Woman’s Concern About Rising Health Insurance Costs

The video gained a lot of attention on TikTok, with thousands of people sharing similar experiences and expressing frustration with how expensive health insurance has become. One person wrote, “They have lost their minds these health insurance companies.” A second said, “These companies are acting like they want us to drop them.” A third remarked, “Ain’t no way!! Between health insurance and property taxes something’s gotta give.”

Another viewer shared that they already fear what their own renewal notices will look like. “I pay 155.00 a month right now. I can’t imagine what mine will be. I’m going to end up not having insurance.. again,” they said.

Others pointed out how health insurance costs and deductibles often do not match the actual benefit received. “$800 a mo & still be having [out of pocket] minimums and deductibles is crazy. Might as well pocket the $800 and just put it aside for when you do need a dr visit,” one user commented.