The budget of a neurosurgeon in San Francisco, California, became everyone’s business on the internet after she made public how she earns and allocates her income, sparking widespread reactions about her salary and spending choices.

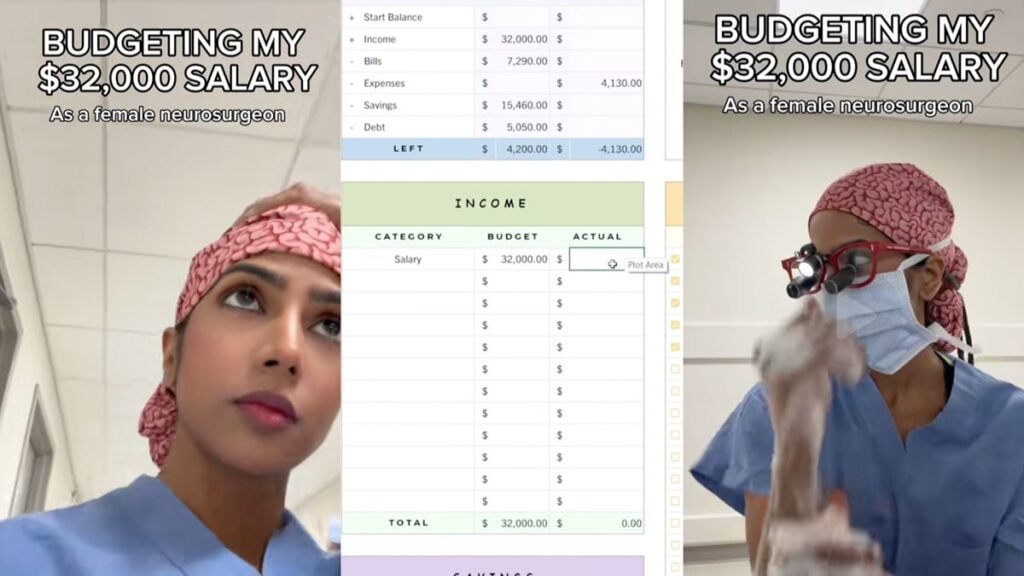

In a video posted on TikTok, the neurosurgeon walked viewers through her budgeting process on payday, showing a spreadsheet divided into categories: income, bills, expenses, savings, and debt. “So I’m sitting down to plan my budget to see exactly where it’s going,” she said. “I start by writing the payday and the amount,” she explained, as she began breaking down the figures. For bills, she allocated $6,000 for rent, $350 for electricity, $120 for internet, $140 for her phone bill, $180 for insurance

She then outlined her monthly expenses — $1,200 for groceries, $900 for eating out, $750 for clothes, $180 for a gym membership, $1,100 for skincare “because stress management is non-negotiable in my job,” she explained, justifying her skincare and self-care spending. She also detailed her debt payments, including $4,200 toward student loans and $850 for her car payment. Savings, which she described as a major priority, included $6,000 into investments, $4,000 into her retirement account, and $1,200 into a travel fund. She added that whatever remained stayed in her checking account.

“A few years ago, this kind of income still felt overwhelming to manage, but now every dollar has a purpose,” she said, encouraging viewers who feel like their money “disappears” to consider budgeting.

However, the comment section was far from unanimously impressed. “$32k/month and she still needs to budget it…😭” one person wrote. Another questioned her earnings, “Why do I feel like $32,000 isn’t that much for this career and the amount of school😩.”

“You save lives, meanwhile men who play football make millions a year- I will never understand this,” another commenter added, comparing her income to that of professional athletes. “Honest question, $1200 groceries for how many people?. I don’t spend that for a family of 7 each month,” one user wrote, suggesting her grocery allocation was high.

Others argued she was underpaid. The comment read, “I still think that’s too low an income for a neurosurgeon. Yes, I know it’s monthly, but you earned that through education, and I would bet your male counterparts are earning more.” A similar comment read, “Way underpaid. Probably working academics or did not negotiate salary well. Hold off on investments, decrease the ‘fancy’ costs, and pay off the student loan asap.”

Housing costs also drew attention. “6500 for an apartment. 😩Please look into a house,” this comment read. Some responded more lightheartedly. “I mean, you can’t get broke with that income right?😅.” While a user applauded her financial discipline. “Good for you. You earned it, and I love the self-care fund.”