Skip To...

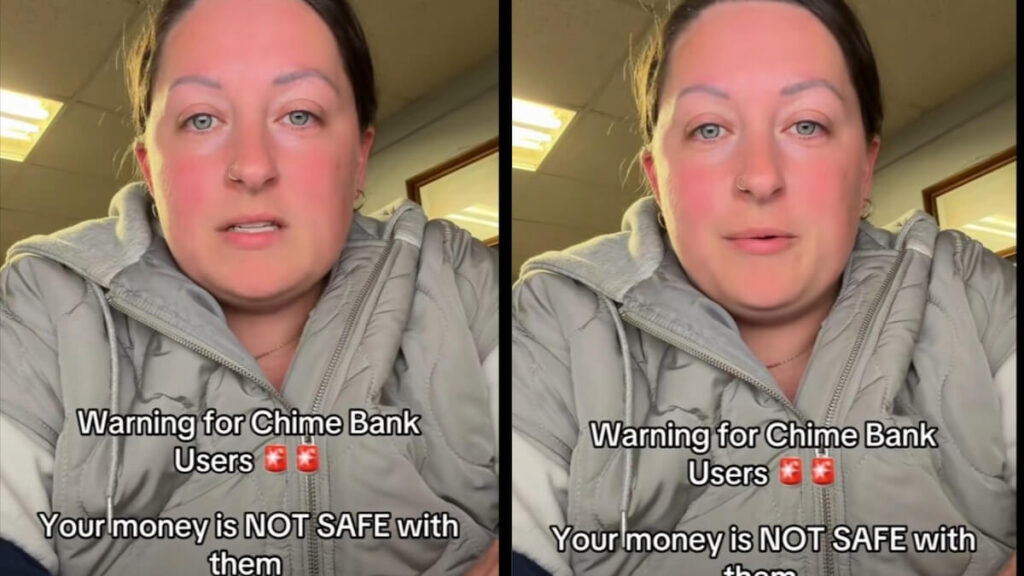

A woman in Pennsylvania has taken to TikTok to warn other Chime customers about her recent experience with the bank, saying that they completely failed her after her account was hacked and $1,000 was stolen. The customer explained in an earlier TikTok that her Chime account was specifically used for one purpose, which was to make monthly payments toward her son’s braces. Each month, she deposited $180 into the account to cover the auto-draft and had recently checked the balance to see that around $1,000 remained, which brought her peace knowing the upcoming payments were already covered.

However, shortly after, she received an alert stating that someone was requesting $500 from that same account, which she found unusual because she is the only person with access to it. When she attempted to log in, her email and username no longer worked, and she then noticed an email notification showing that the login email associated with the account had been changed days earlier.

Realizing the account had been hacked, she immediately contacted Chime’s customer service and fraud department, who helped her file a dispute and advised her to wait for updates. At that point, she felt encouraged and believed the situation would be resolved in her favor.

She Says Chime Denied Her Fraud Claims Twice in Less Than 48 Hours

At first, she remained positive, assuming the fraud department could clearly see evidence that her account was accessed without her authorization. However, after her claim was denied twice in less than 48 hours, her confidence quickly shifted to frustration. She said that even though representatives on the phone could see that the account was accessed from a different location and that funds were transferred to another account, her dispute was still rejected, with Chime stating that “no error has occurred.”

She also pointed out that before customers are able to speak to a live representative, they must first go through an automated system, which she claims tells users that even if fraud is confirmed, they may not be refunded. “I don’t understand how any bank that has any sort of insurance can just so quickly turn their back on you and not offer you any sort of support,” she said.

Now, she is urging people to move their money elsewhere before they end up in the same situation. “Don’t do business with them. Pull your money out. Put it somewhere else. Chime will not have your back,” she said.

Netizens React to the Pennsylvania Woman’s Warning About Chime

Several people in the comments agreed with her claims, saying they experienced something similar. One person wrote, “She ain’t lying!!! I’ve had it happen to me!” Another said, “This happened to me. I was laying down and somebody got into my account and transferred it to somebody else’s Chime. I never kept money on there ever again.” A different viewer commented, “I got robbed of 1000 bucks and they closed my account because I reported it.”

A few also raised concerns about Chime’s status as a financial platform. “They also are not really considered a bank. They’re not FDIC insured. What they are is considered a technology company,” one viewer pointed out. Someone else remarked, “People really need to stop using these financial apps. They aren’t banks.”

However, there were still netizens who shared that they’ve used Chime for years without issues. One comment read, “Been using them for like 4 yrs and never had a problem.” A second added, “I’ve had Chime since the beginning of their existence and NEVER had an issue… normally they assist me very quickly.”