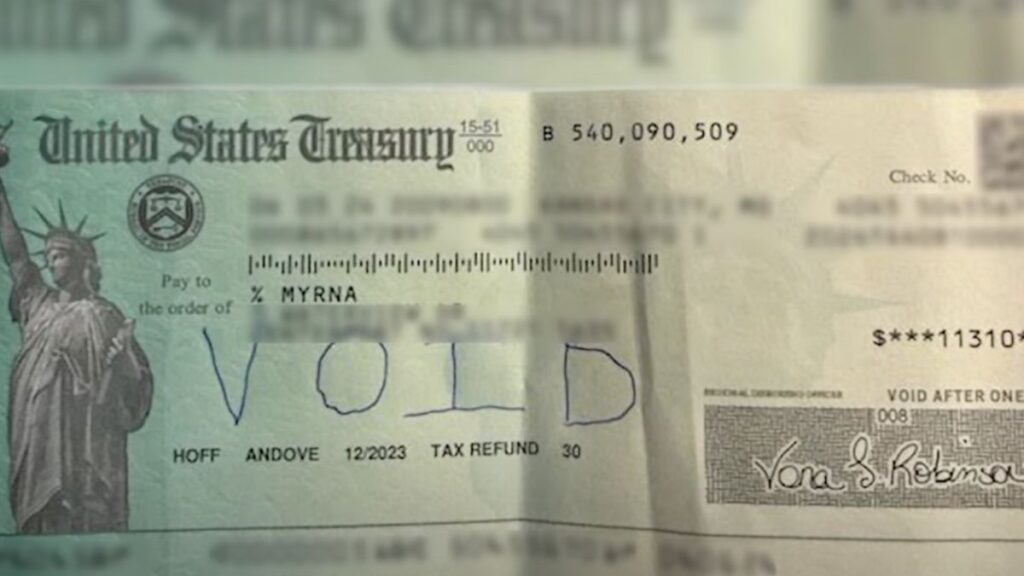

A crucial mistake from the IRS left New Yorker Debra fighting a red tape war to get her sick mom’s $11,000 tax refund. Debra’s mom, Myrna Hoffman, who suffers from dementia, was issued her 2023 tax refund. However, her daughter was unable to cash it because the IRS had made a typo in Hoffman’s name. What should have been a straightforward process turned into a bureaucratic nightmare.

Speaking to ABC 7, Debra detailed how the fatal blunder prevented her from accessing the money and her attempts to make it right. According to the New Yorker, when her mother’s check came in, it only carried the percent sign and her first name. Myrna’s last name was missing, making it impossible for her to cash the check. Hoping to correct the error, Debra reached out to the Internal Revenue Service, but all her efforts were futile.

“When I finally did get in touch with someone, they told me it would be 30 days, and then you’ll get a new check, and then that didn’t happen,” she recalled.

Sadly, months passed, and nothing was done. Unfortunately, Debra’s mom soon fell ill, and things became tight financially. Yet, they didn’t have access to Myrna’s money.

“I couldn’t believe it. I didn’t know that. You know that the United States Treasury would make a mistake such as that without a person’s last name on it.”

Fortunately, Debra contacted the media to tell her story, and they played a significant role in ensuring the typo was corrected. ABC7 NY reached out to the IRS, and a correct check was re-issued to her mom. Thankfully, the situation was resolved with no drama. Celebrating the win, Debra gushed, “I’m just so excited, and, you know, it was so stressful, and now I can feel good again.”

Debra and Myrna Hoffman might not be the only Americans to endure such a fate, especially with the recent cuts to the IRS department. Thousands of IRS workers were laid off thanks to Trump and Elon Musk’s cost-cutting DOGE policies. Unfortunately, the mass termination coincides with tax season, which began on January 27. Luckily, they have until April 15 to file in order to get federal returns. However, those who don’t meet up with the deadline can file for an extension until October 15, 2025.

As expected, the massive cuts are predicted to delay citizens getting their tax returns. Hopefully, it doesn’t get as drastic as the Hoffmans’ situation.