Arguably one of the worst financial situations a person can experience is going bankrupt. Even though money is not everything in life, it is still extremely important for stability, housing, transportation, and overall peace of mind. Reaching the point of bankruptcy usually means that debt has grown so overwhelming that it can no longer be managed. It is a situation most people work very hard to avoid. A TikToker from Pensacola, Florida, who goes by the username @emilymccranie94, recently opened up about her own experience with bankruptcy and debt in a video that quickly gained attention. While stories like this usually earn sympathy or support online, her confession instead sparked heavy criticism and disbelief from viewers.

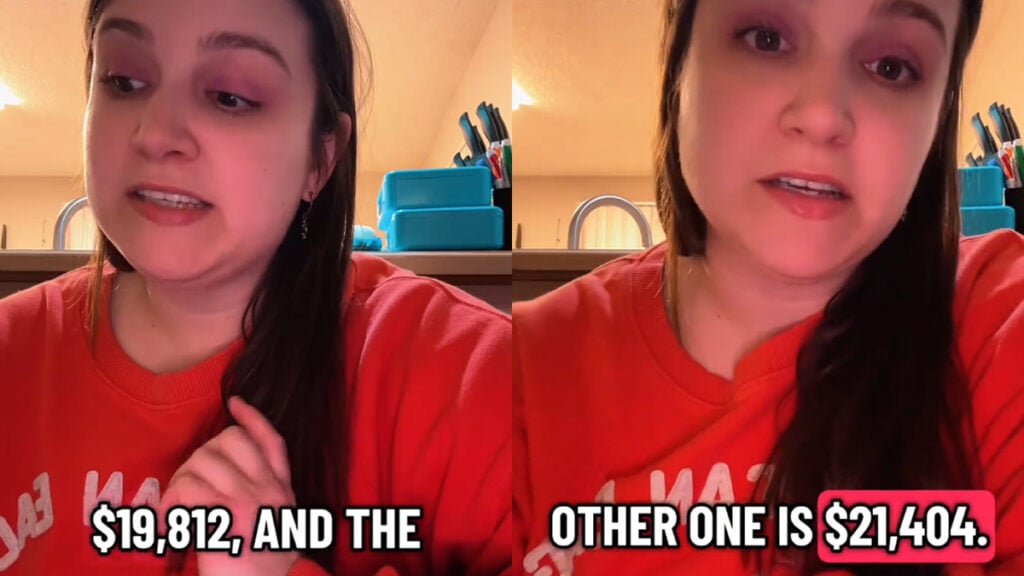

According to her own statements, she filed for bankruptcy six years ago. Now, the Pensacola TikToker says she has accumulated a large amount of debt once again. In her video, she broke down the numbers and explained how she arrived at a total of $92,589 in debt. She claimed the biggest contributors were two vehicles she and her husband purchased. One of the cars reportedly cost $19,812, while the other was priced at $21,404, totaling more than $40,000 spent on vehicles alone.

In addition to the cars, the Pensacola TikToker said that credit card balances between her and her husband had climbed to $32,715, along with $18,618 in various loans. Hearing those figures was enough to stun many viewers. For most average people, a debt nearing $100,000 feels unimaginable and overwhelming, even terrifying. It is the kind of financial burden that can keep someone up all night, wondering how they will ever climb out of it.

“As a bankruptcy specialist, you learned nothing,” one commenter wrote under her video. Many others echoed that sentiment, criticizing both her and her husband for making what they saw as irresponsible and reckless choices. Several users pointed out that while cars are useful, they are not strong investments, since they lose value quickly over time. To them, buying expensive vehicles after already going through bankruptcy seemed like repeating the same mistake all over again.

Some viewers even began speculating about how the couple managed to get approved for such large amounts of credit after previously declaring bankruptcy. A few theorized that predatory lenders or high-interest auto loan companies might be involved, though this was never confirmed. One person commented, “Definitely went to one of those predatory auto loan places where they got 30% interest at best.”

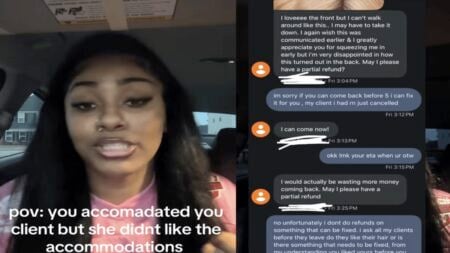

Others also questioned why she had taken on additional debt for furniture. In her explanation, she compared the process to installment services like Affirm. She said she and her husband needed new furniture when they moved into their current home and chose to order from Wayfair, believing they were saving money in the long run. She also claimed that the furniture balance was almost paid off.

Despite the intense backlash and criticism, the TikToker remained surprisingly positive in her attitude. She acknowledged her situation and insisted that, this time around, she and her husband would not file for bankruptcy again. According to her, they were determined to take control of their finances and work toward paying off what they owed.